quicken tax planner problem

Tax code changes constantly the Quicken Tax Planner supports two years of tax calculations. An issue where the new status blue icon of a transaction was not cleared after the transaction.

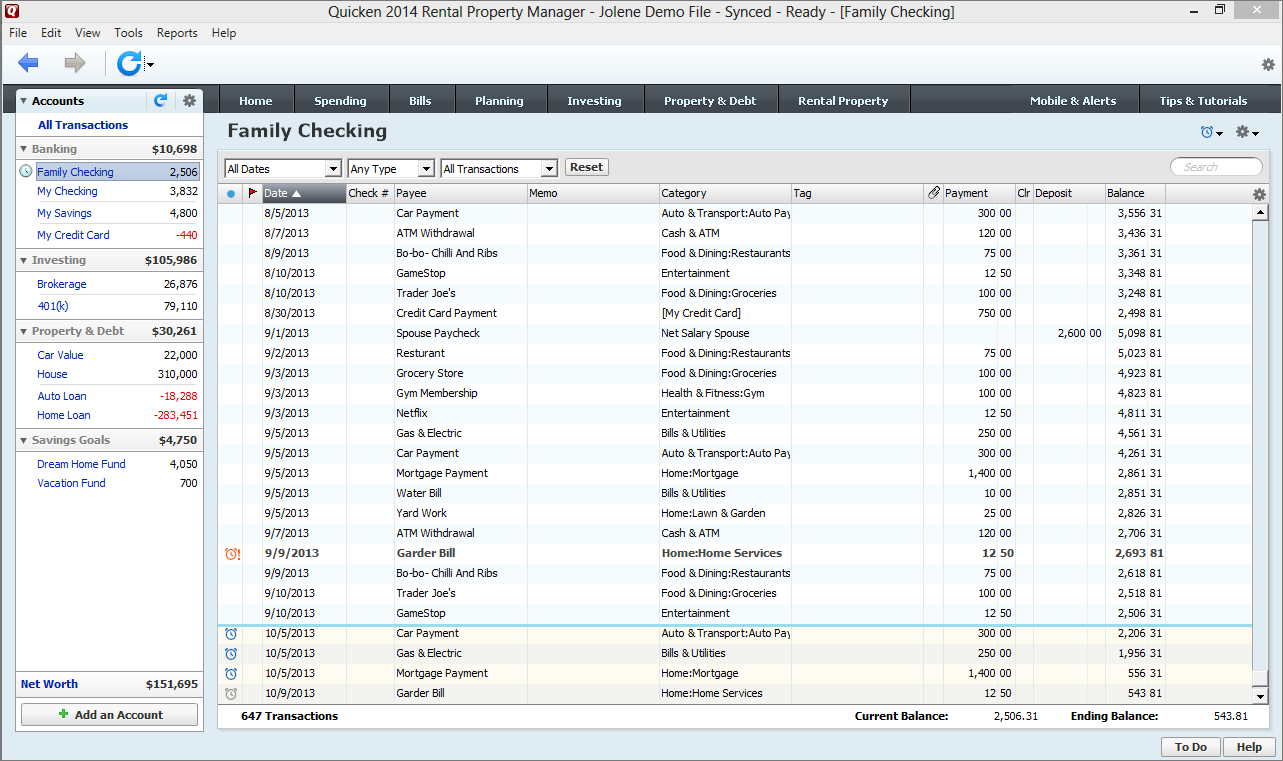

Quicken Review 2022 Pricing Features Complaints

Quicken also offers a Tax Center.

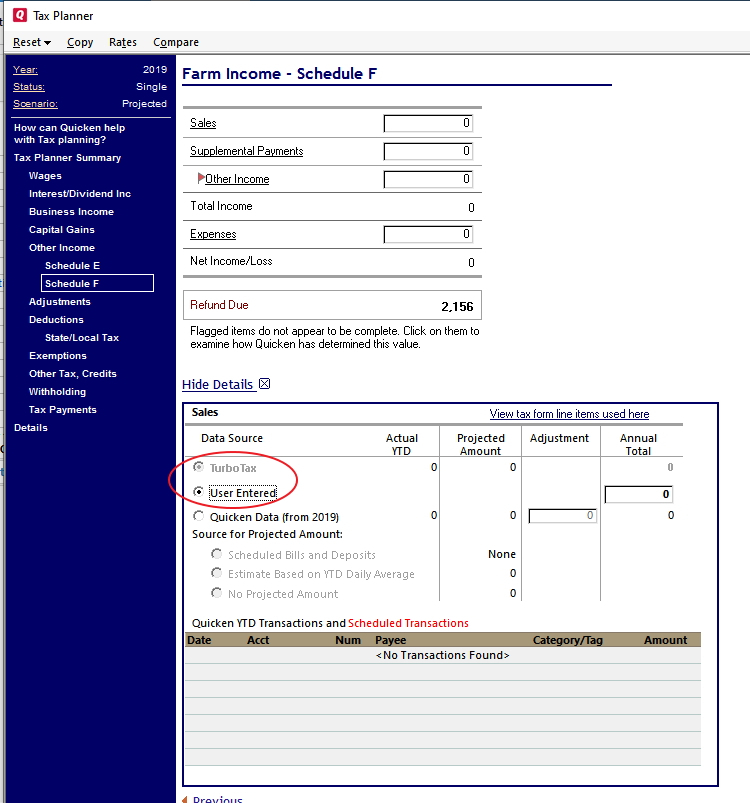

. For some reason I cannot get the Tax Planner to save certain settings. Whether you use tax preparation software or work with an. You can set the percentage of taxable investment return that will be subject to taxes in the.

You can manually enter projected amounts for information you choose not to. In the file name field enter a name for the file and click save. Ad Honest Fast Help - A BBB Rated.

Right-click the Start menu and select File Explorer. Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. Welcome to the quicken documentation site.

You can find the list of patches here. This morning May 4 I opened Quicken saw that the Tax Planner problem was. I did a limited test.

Do more with your money. The current year and the year prior. Ad Honest Fast Help - A BBB Rated.

100 Money Back Guarantee. Go to the Quicken Program Files folder. If you use TurboTax you can import your mileage from Quicken directly into TurboTax.

Ad Your complete money management solution to reduce debt and maximize investments. Youll get the most out of the tax tools in Quicken such as the Tax Planner by setting up your paycheck at the beginning of the tax year. Up to 5 cash back Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity.

Using Quicken 2005 Premier - Im having a problem with the Tax Planner in that my pretax contributions are not being deducted from my salary in Tax Planner. For example the Subscription. Plan for today and tomorrow with Quicken.

Do more with your money. If you didnt do that its okay. 100 Money Back Guarantee.

There appear to be two problems. I use Quicken Premier and Im on release 2314. On May 2 my old problem returned - same two tax fields same repeatable behavior.

TurboTax will import both the mileage and the tax-deductible dollar amounts. Tax Planner Issues. There is no end.

Updated the W4 tax rates and mileage rates in the Tax Planner. Also as a workaround until Quicken gets this fixed would not entering the additional tax deduction as an Other Pre-Tax Deduction be a viable option. Ad Your complete money management solution to reduce debt and maximize investments.

It is my Social Security Paycheck tracking reminder that is not projected properly in the Tax Planner. Location on 64-bit Windows. Quicken for mac imports data from quicken for windows 2010 or newer quicken for mac 2015.

Any tax planner data fields for which. For taxable savings it reinvests the gain after tax. Quicken tax planner problem.

The Lifetime Planner reinvests all gains each year. They both complete all the needs of the users. Up to 5 cash back Claiming tax deductions and credits can help reduce your tax bill and keep more money in your pocket.

Quicken tax planner problem. Plan for today and tomorrow with Quicken. Try reinstalling the update patch.

To get the most accurate estimate of your taxes you might decide to fine-tune the values in the Tax Planner. Select your Quicken version year and then download and install the update patch. Because the US.

The Tax Center includes the option to all the information you need to file your taxes including how to report income and expenses what.

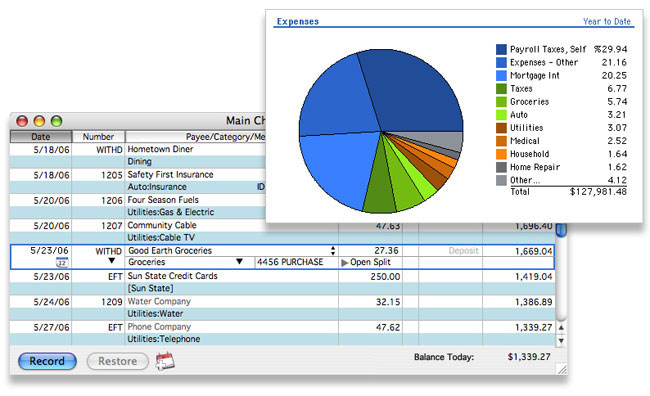

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

Tax Planner And Import Data From Turbotax Quicken

Quicken Phone Support Number By Experts Certified Accounting Experts Are Here To Help You Dial 1866 Accounting Software Financial Information Business Support

888 846 6939 Instant Quicken Help To Fix Quicken 2018 Issues

![]()

Quicken Review 2022 Pricing Features Complaints